Skipping meals to save time, but finding yourself exhausted and unproductive by the afternoon. Choosing a cheaper apartment to save money, but the long commute ends up costing you time and energy.

You tried to make the most sensible choice, and yet… What went wrong?

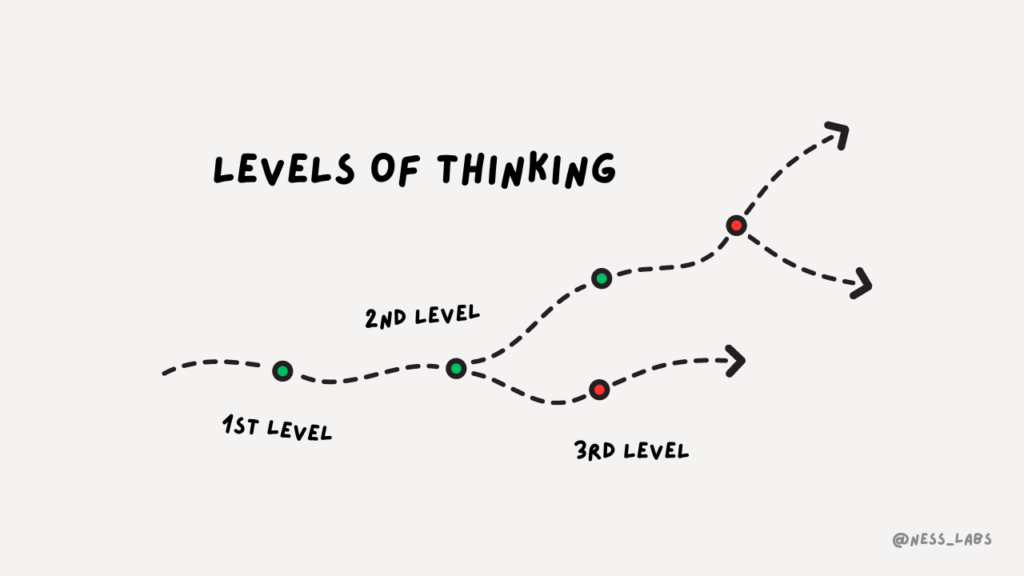

It’s easy to get carried away when making a decision. We look at the current situation and extrapolate what we consider to be the most likely future outcome. But we often fail to consider the complex ramifications of the decisions we make.

For instance, let’s say you’re offered a job with an attractive salary, and you accept it immediately without considering the company’s culture or long-term career prospects. This quick decision based on immediate benefits is an example of first-level thinking.

Now, imagine you pause, consider the job offer not just for its salary but also for the growth opportunities and work-life balance. This more deliberate decision is an example of second-level thinking.

Those terms were coined by Howard Marks in his book The Most Important Thing, which describes his investment philosophy and his insights into navigating volatile markets:

“First-level thinking is simplistic and superficial, and just about everyone can do it (a bad sign for anything involving an attempt at superiority). All the first-level thinker needs is an opinion about the future (…) Second-level thinking is deep, complex and convoluted.” — Howard Marks, Investor & Writer.

First-level thinking often results in snapshot decisions. We just look at the information in front of us and other obvious indicators, and we make our choice. This is a perfectly natural reaction, but more often than not we don’t need to make decisions that quickly.

The pitfalls of first-level thinking

Think about a recent decision you made—did you consider the second-level consequences? Making decisions based on immediate outcomes might seem efficient, but it ignores the complex interconnections of real-life situations.

This is why first-level thinking can lead to decisions that feel good in the moment but have unintended outcomes.

Prioritizing immediate rewards over sustainable growth can lead to poor long-term outcomes. Focusing only on the obvious benefits while overlooking potential hidden costs can result in financial strain. Making decisions without considering the ethical ramifications can damage your reputation and relationships in the long run.

On the other hand, second-level thinking can result in extraordinary performance. When we take the time to consider the second and third order consequences, including our own biases, disentangling the signal from the noise, we’re more likely to determine the most favorable decision.

How to cultivate second-level thinking

In his book, Howard Marks shares a few questions you can ask yourself to move away from superficial first-level thinking and into more complex second-level thinking. I slightly edited them to make them applicable outside of investing.

- What is the range of likely future outcomes?

- Which outcome do I think will occur?

- What is the probability I’m right?

- What does the consensus think?

- How does my prediction differ from the consensus?

- How does the current situation align with the consensus view of the future, and with mine?

- What will happen if the consensus turns out to be right, and what if I’m right?

You can also apply second-level thinking to personal decisions. In that case, comparing your prediction to what most other people think—the consensus—may not be as useful. Instead, you can use the following 10-10-10 questions:

- How will I feel about it 10 minutes from now?

- How will I feel about it 10 days from now?

- How will I feel about it 10 months from now?

These will encourage you to go beyond first order consequences and to consider the complex and sometimes unwanted effects of your choices. By cultivating this habit, you’ll end up making smarter decisions in the long run.